In this scenario, the Atal Pension Yojana (APY) is the strongest instrument for the unorganized sector, as society ages the need for more amount in the twilight of our lives is an eminent one. The scheme was introduced by the Government of India in the year 2015, which provides the participant with an assured monthly pension during his/her old age after retirement. If you do not have EPF benefits, then be it a self-employed, or a daily wage worker, APY is a golden chance to secure your coming days.

What is Atal Pension Yojana? (Atal Pension Yojana Kya Hai)

Looking at the features and the benefits of Atal Pension Yojana (APY), it appears that the core purpose of APY is to ensure a secured pension to people in their old age. It is principally intended for laborers it does take part in the unorganized sector as it is a confirmation that they won’t confront budgetary incapacity after retirement. The supporters can save as per their desire and withdraw a monthly pension of ₹1,000 to ₹5,000 at the age of 60 and above depending on the plans they had selected. Government jobs often come with pension benefits, but APY extends this security to those in the unorganized sector, ensuring broader financial inclusivity.

Essential Features of Atal Pension Yojana

It will provide a government-guaranteed pension of ₹1,000-₹5,000 per month to beneficiaries.

Variable Contribution: Participants can make contributions according to their retirement strategy.

The contributions will be auto-debited from subscribers’ designated savings bank accounts.

Tax Advantages: APY subscribers qualify for tax deductions under Section 80CCD(1B) of the Income Tax Act.

Nomination Facility: A subscriber can nominate a beneficiary who will receive the corpus in case of the subscriber’s death.

Second, Joint Contribution for Spouses: If the married couple enrolls, they also receive a secure two pensions in retirement.

Benefits of Atal Pension Yojana (Atal Pension Yojana Benefits)

- Guaranteed Pension: The pension amount is assured, providing a stable post-retirement income.

- Government Support: The Government of India supports APY by ensuring the pension amount remains fixed.

- Encourages Savings: The scheme helps individuals develop a habit of regular savings for their future.

- Financial Independence: It ensures that retirees do not have to depend on family members for financial support.

- Affordable Contributions: Contributions start as low as ₹42 per month, making it accessible for low-income individuals.

Eligibility Criteria & Required Documents

- Eligibility Required Documents

- Eligibility Criteria:

- Must be an Indian citizen.

- Minimum Age: 18 Years Maximum Age: 40 Years

- Having savings bank account is a must-have.

- Must not have been registered in any other social security scheme

Required Documents:

- (Aadhaar card for identity verification)*

- Details of bank account* (with auto-debit facility)*

- Mobile number linked to Aadhaar and bank account

- Address proof

- Nominee details

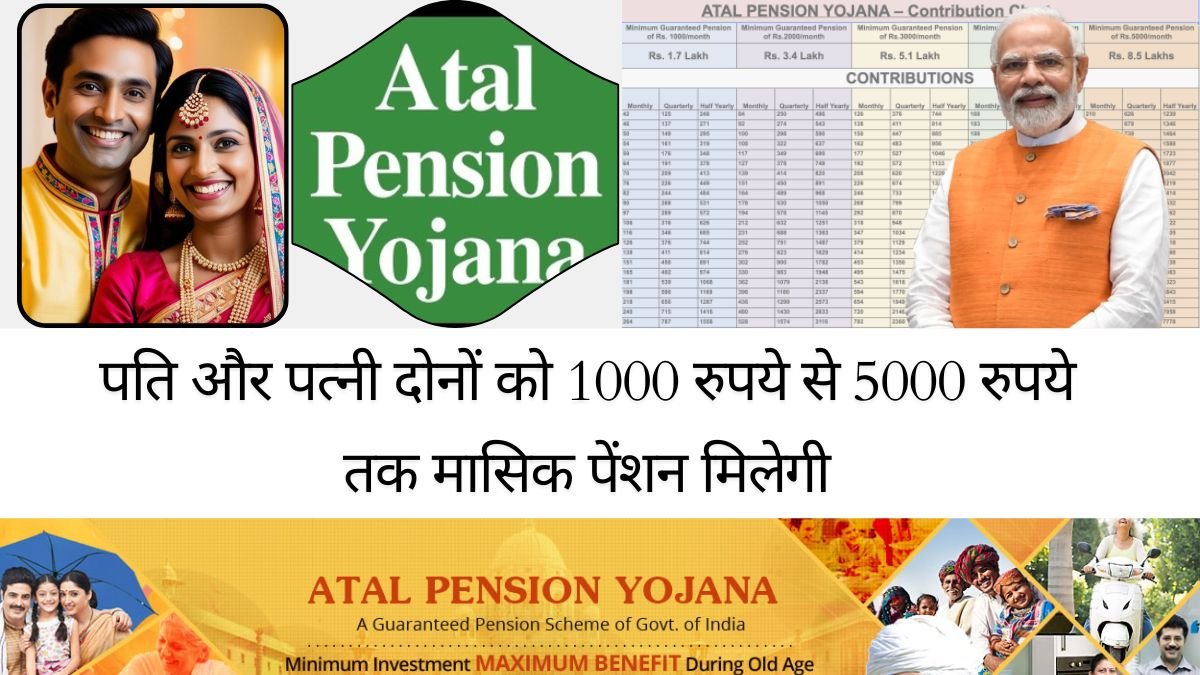

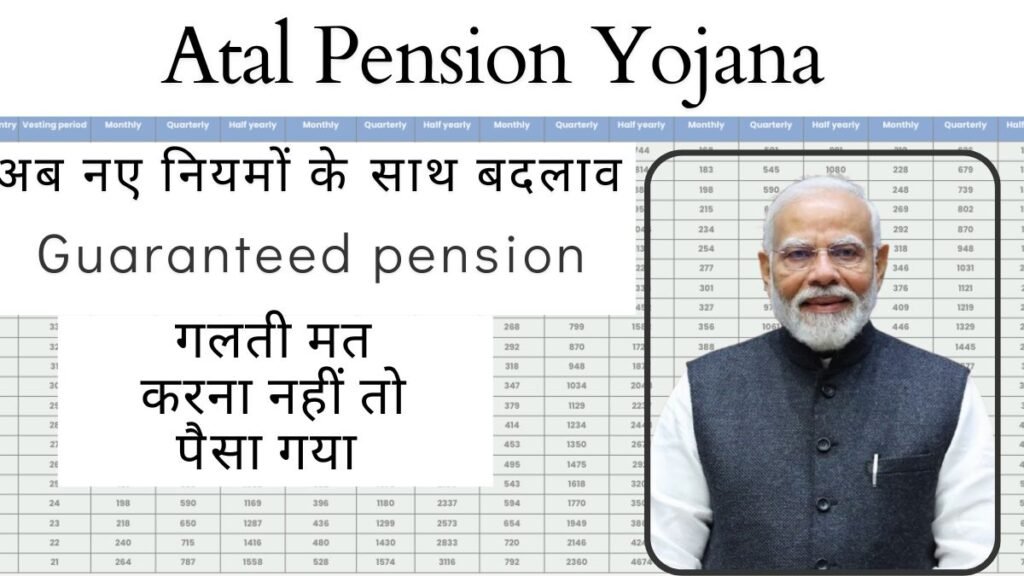

Contribution & Pension Amount (Atal Pension Yojana Chart)

Below is the Atal Pension Yojana map, showing the yearly donation needed based on the age of the subscriber and the pension quantum asked

| Age | ₹1,000 Pension | ₹2,000 Pension | ₹3,000 Pension | ₹4,000 Pension | ₹5,000 Pension |

| 18 | ₹42 | ₹84 | ₹126 | ₹168 | ₹210 |

| 25 | ₹76 | ₹151 | ₹226 | ₹301 | ₹376 |

| 30 | ₹116 | ₹231 | ₹347 | ₹462 | ₹577 |

| 35 | ₹181 | ₹362 | ₹543 | ₹723 | ₹904 |

| 40 | ₹291 | ₹582 | ₹873 | ₹1,164 | ₹1,454 |

Contributions are auto-debited monthly, quarterly, or half-yearly.

How to Calculate Your Pension( Atal Pension Yojana Calculator)

To determine your pension quantum and donation, you can use the Atal Pension Yojana calculator, which is available on the sanctioned websites of banks and the Pension Fund Regulatory and Development Authority (PFRDA).

Steps to Use the Calculator

- Enter your age.

- elect your asked pension quantum.

- The calculator will display the yearly donation needed.

- It also shows the total donation until withdrawal.

How to Apply for Atal Pension Yojana?

Offline Method

Visit any nationalized bank or post office.

Fill out the APY registration form.

Submit the form along with KYC documents.

Link your savings regard for the bus- disbenefit.

Online Method

Log in to your net banking account.

Navigate to the APY registration section.

Fill in the necessary details and submit the form.

Enable bus- disbenefit for benefactions.

Atal Pension Yojana Scheme vs Other Pension Schemes

| Feature | Atal Pension Yojana | National Pension System (NPS) | Employee Provident Fund (EPF) |

| Type | Government-backed | Market-linked | Employee contribution-based |

| Eligibility | 18-40 years | 18-65 years | Salaried individuals |

| Guaranteed Pension | Yes | No (depends on market returns) | No (depends on contributions) |

| Contribution | Fixed | Flexible | Employer + Employee contribution |

| Tax Benefits | Yes | Yes | Yes |

Atal Pension Yojana Status

Checking the status of your Atal Pension Yojana( APY) account is essential to ensure that your benefactions are being reused correctly and that your pension benefits remain complete. The status check helps in tracking payments, vindicating benefactions, and resolving any issues related to business benefits failures or account disagreements.

How to Check Atal Pension Yojana Status Online?

You can check your Atal Pension Yojana status through the following styles

1. Using the Official PFRDA Website

Visit the NSDL- CRA or Karvy- CRA functionary website.

Click on APY Subscriber Services.

Enter your PRAN (Permanent Retirement Account Number) or Bank Account Number.

corroborate the OTP transferred to your registered mobile number.

Your Atal Pension Yojana Status will be displayed, including, donation, details, and forthcoming payment schedules.

2. Through Net Banking

Log in to your bank’s net banking gate.

Navigate to the APY account section.

Select Check APY Account Status.

Your current status, benefactions, and pension details will be displayed.

3. Via SMS Alerts

still, you’ll admit periodic SMS cautions regarding your APY benefactions and balance status, if you have registered your mobile number.

You can also check the last sale by transferring an SMS to the designated number handed by your bank.

4. Visiting the Bank

Visit the bank branch where you enrolled in APY.

give your Aadhaar or bank account number.

The bank functionary will update you on your benefactions, balance, and status.